-If we clean and clear clutter for 15 minutes, how much nicer will the apartment look?

-What happens if we just don't buy junk food at the grocery store for a couple of months?

-How long can we go without eating at a restaurant?

-If we save $X in Y weeks, we can treat ourselves to something fun

Over time, we've become more healthy, more active, and far more financially savvy. And because I care, I share.

When thinking about the simplest way to talk about some of the changes we made, especially in the area of money management, I consistently look to The Simple Dollar. Trent didn't strike it rich and then decide to preach to investors. He hit rock bottom, his spending out of control, his future bleak and decided to turn his life around. Trent writes about his struggles with frugality, teaching his children about the value of a dollar and saving for wants, and how to spend less without sacrificing.

Note from Ms. Divine: I'd like to take a moment to stand on my soapbox for an important announcement: Frugal does not equal cheap. It doesn't mean becoming a recluse, eating cans of bean and sacks of rice, buying only on clearance, etc. To me, being frugal simply means choosing to spend less on things that aren't important so that you can spend more on things that matter. Your definition of important may be different from mine, and that's okay.

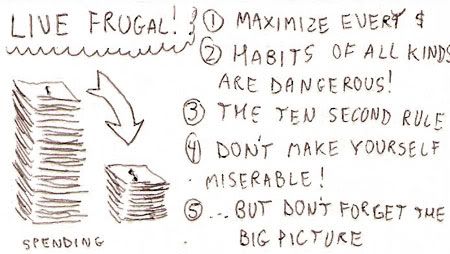

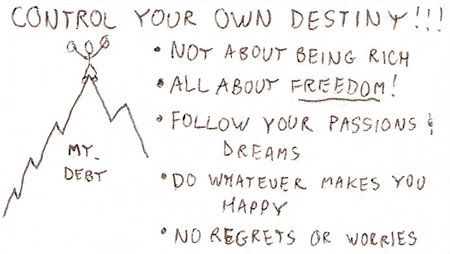

Back to Trent! One of his best posts, and the one I consistently recommend to others is basically the perfect elevator pitch about spending less, earning more, living frugal [not a dirty word!], managing money, and controlling your own freedom. Though this information was posted on his blog in 2007, the principles are time-tested and terrifically simple. And the method of explaining them is quite effective:

Everything You Ever Really Needed to Know About Personal Finance on the Back of Five Business Cards

Not everything can be tackled at once, don't get overwhelmed and close the page! It may take decades to get to the points where all your debts are repaid, you're saving for the future and you're able to do what makes you happy. We've got the spending less than we earn principle down pat, have a healthy emergency fund, and are becoming better and better at understanding wants versus needs and making less-bad spending choices.

On the other hand, we're not the greatest at networking, we can't imagine having the time or energy to start side businesses and the concept of investing and maxing out retirement savings is a lofty goal farrrrrr into the distance. Baby steps, right?

What one change do you think you can take today, this week, or this month to improve your finances? What's stopping you from taking that baby step?

Hey - why did you stop doing wedding planning? That is perfect for you and rocked that first one you did.

ReplyDeleteThe most important part of being financially fit is BOTH parties are on the same page (when married obviously) otherwise you are spinning your wheels.

Dave Ramsey is very much along the same lines, but he just sounds like GWB when he talks (lol.)

For me, planning meals out on weekends and then shopping specifically not only reduces the amount of impulse buying I would otherwise do, but it helps me plan menus arounds grocery store sales / coupons and keeps me on track. I LOVE knowing what is for lunch and dinner days in advance. It gives me time to focus on other things. :-)

I'd love to do more weddings, I just can't figure out the next step of finding more people to help!

ReplyDeleteTotally agree that communication is key - it amazes me how many couples don't TALK about these things, whether it's money, children, career goals, etc!

Perhaps if I ate a wider variety of foods, I'd hope on the meal-planning train...working on it!! :)